Navigating the Landscape of Home Decor in India: A Comprehensive Guide to Harmonized System (HS) Codes

Related Articles: Navigating the Landscape of Home Decor in India: A Comprehensive Guide to Harmonized System (HS) Codes

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Home Decor in India: A Comprehensive Guide to Harmonized System (HS) Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Home Decor in India: A Comprehensive Guide to Harmonized System (HS) Codes

The Indian home décor market is vibrant, diverse, and constantly evolving. Understanding the intricacies of this sector, particularly in relation to import and export, requires familiarity with the Harmonized System (HS) codes. These codes, developed by the World Customs Organization, provide a standardized classification system for goods traded internationally, facilitating smooth customs clearance and accurate tariff calculations.

This article delves into the realm of HS codes specifically relevant to home décor products in India, offering a comprehensive guide for businesses and individuals involved in this industry.

Understanding the Significance of HS Codes

HS codes are not merely arbitrary numbers; they are the language of international trade. They play a pivotal role in:

- Tariff Determination: HS codes dictate the specific import duties and taxes applicable to a particular product, ensuring fair and transparent trade practices.

- Trade Statistics: By categorizing goods, HS codes enable the collection of accurate trade data, providing valuable insights into market trends and patterns.

- Customs Clearance: Accurate HS codes facilitate swift customs clearance, minimizing delays and streamlining the import/export process.

- Product Identification: HS codes serve as a unique identifier for specific products, facilitating communication and documentation across borders.

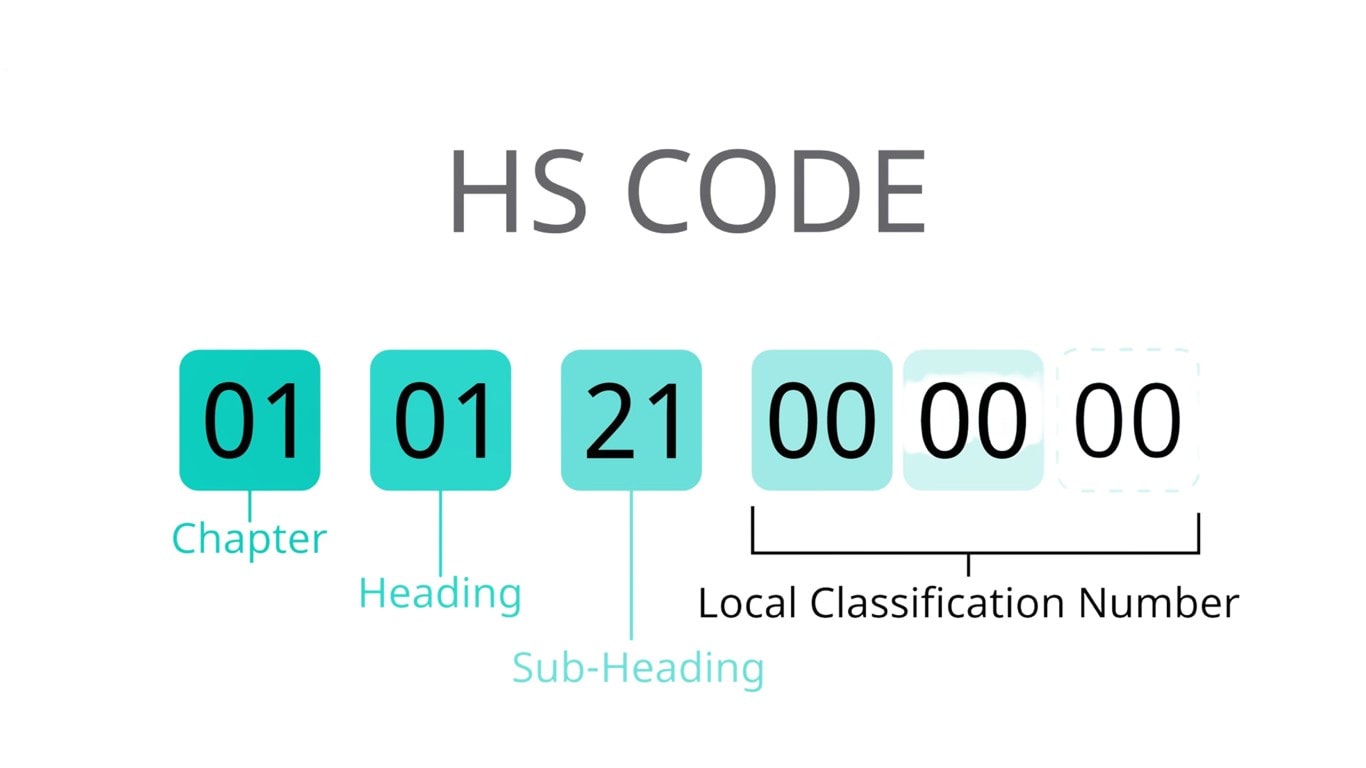

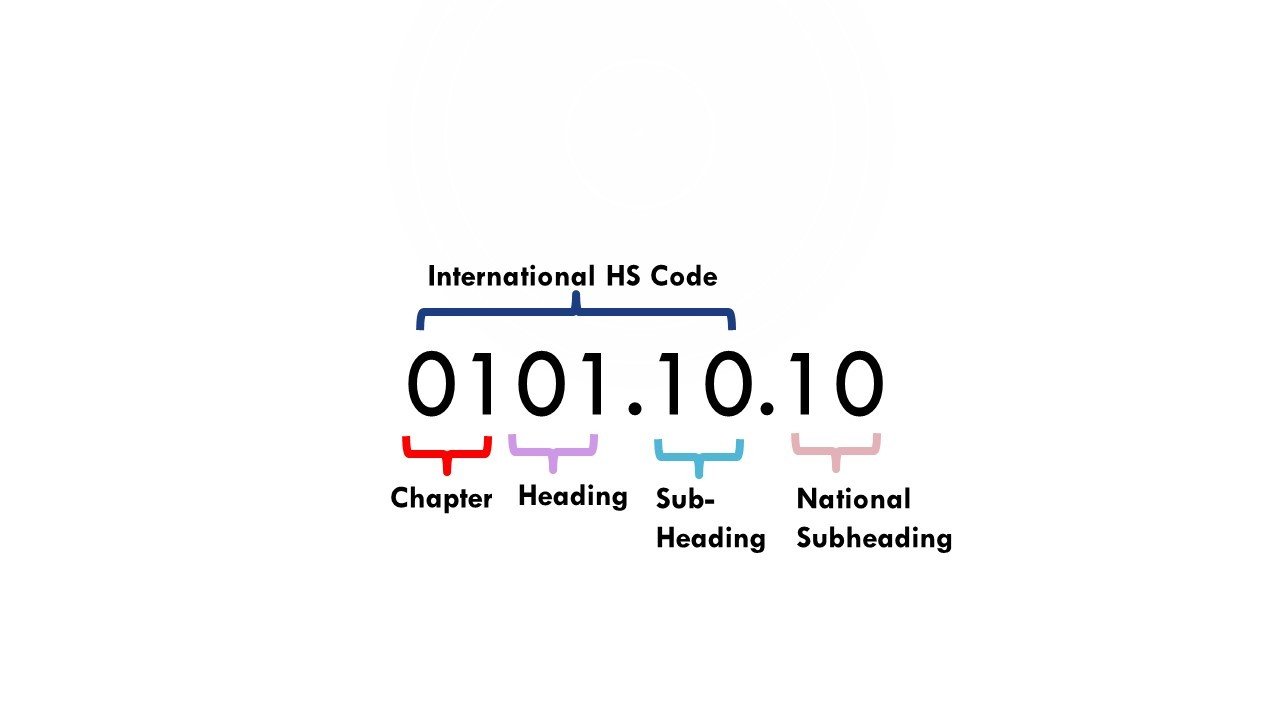

Decoding the HS Code System

The HS code system employs a hierarchical structure, with each product assigned a unique six-digit code. The first two digits represent the chapter, followed by four digits that further refine the product category. For instance, Chapter 63 pertains to "Articles of apparel and clothing accessories, not knitted or crocheted," while the code 6304.11.00 refers specifically to "Men’s or boys’ suits, ensembles, jackets, blazers, and the like, of wool or fine animal hair, knitted or crocheted."

Home Décor HS Codes in India: A Detailed Breakdown

The home décor category encompasses a wide range of products, each with its unique HS code. Here’s a comprehensive breakdown of some key categories and their corresponding HS codes:

1. Furniture (Chapters 94 & 95)

- 9401.10.00: Seats (other than seats of vehicles) – Sofas, settees, and similar seating furniture

- 9401.20.00: Seats (other than seats of vehicles) – Armchairs, easy chairs, and similar seating furniture

- 9401.30.00: Seats (other than seats of vehicles) – Other seating furniture

- 9401.60.00: Furniture, fitted with a bed-base, and mattresses

- 9401.70.00: Furniture, fitted with a bed-base, but not mattresses

- 9401.90.00: Other furniture, not elsewhere specified or included

- 9402.00.00: Cabinets, chests of drawers, dressing-tables, toilet tables, vanity tables, and similar furniture

- 9403.00.00: Beds (other than folding beds) and bedsteads

- 9503.00.00: Folding beds, camp beds, cots, and other similar furniture

- 9504.00.00: Mattresses, cushions, and similar stuffed furniture, whether or not fitted with a bed-base

2. Carpets and Rugs (Chapter 57)

- 5701.00.00: Carpets and rugs, knotted, woven, or made up by hand

- 5702.00.00: Carpets and rugs, woven, other than knotted

- 5703.00.00: Carpets and rugs, tufted or otherwise made up by machine

- 5704.00.00: Floor coverings, not elsewhere specified or included

3. Lighting Fixtures (Chapter 94)

- 9405.10.00: Lamps and lampshades, of metal

- 9405.20.00: Lamps and lampshades, of other materials

- 9405.30.00: Lighting fittings, not elsewhere specified or included

4. Decorative Items (Chapters 69, 70, 71, 95)

- 6901.00.00: Ceramic tiles, flagstones, and similar articles

- 7013.00.00: Glass mirrors

- 7101.00.00: Articles of natural or cultured pearls, precious or semi-precious stones (excluding articles of Chapter 7113)

- 9505.00.00: Statuettes and other ornamental articles, of base metal

- 9506.00.00: Statuettes and other ornamental articles, of other materials

5. Home Textiles (Chapters 52, 53, 58, 59)

- 5201.00.00: Cotton yarn

- 5301.00.00: Wool yarn

- 5801.00.00: Woven fabrics of cotton

- 5802.00.00: Woven fabrics of wool

- 5901.00.00: Woven fabrics of man-made fibers

6. Kitchenware and Tableware (Chapter 70)

- 7010.00.00: Glassware for table use

- 7017.00.00: Glassware for cooking or household use

7. Wall Decor (Chapter 48)

- 4801.00.00: Newsprint

- 4802.00.00: Paper and paperboard, in rolls or sheets

- 4803.00.00: Paper and paperboard, corrugated

- 4804.00.00: Paper and paperboard, coated

- 4818.00.00: Printed books, brochures, leaflets, and similar printed matter

8. Home Fragrance (Chapter 33)

- 3307.00.00: Perfumes and toilet waters

- 3307.10.00: Perfumes

- 3307.20.00: Toilet waters

- 3307.90.00: Other perfumed preparations

Navigating the HS Code System: Tips for Success

- Consult with Experts: Seek guidance from customs brokers, trade consultants, or industry associations for accurate HS code identification.

- Utilize Online Resources: The Indian government’s official website for customs and excise, along with websites of international trade organizations, offer valuable resources and search tools.

- Thorough Product Description: Provide detailed descriptions of your home décor products, including materials, construction, and intended use, for accurate HS code assignment.

- Stay Updated: HS codes are periodically updated to reflect changes in trade practices and product classifications. Regularly check for revisions to ensure compliance.

Frequently Asked Questions (FAQs) on Home Décor HS Codes in India

1. How do I find the correct HS code for my home décor product?

The most accurate method is to consult with a customs broker or trade consultant. Online resources like the Indian government’s customs website can also provide guidance.

2. What happens if I use the wrong HS code?

Incorrect HS codes can result in delays in customs clearance, penalties, and inaccurate tariff calculations.

3. Are there any exemptions or concessions on import duties for home décor products?

Exemptions and concessions may be available depending on the specific product, origin, and trade agreements. Consult with relevant authorities for detailed information.

4. How can I ensure that my products comply with Indian import regulations?

Stay informed about import regulations, including quality standards, safety requirements, and labeling guidelines. Engage with industry associations and seek professional advice when necessary.

5. What are the implications of Brexit on HS codes for home décor imports from the UK?

Post-Brexit, trade between India and the UK is subject to new customs procedures and tariff regimes. Consult with customs authorities and trade experts for updated information on HS codes and import regulations.

Conclusion

Mastering the intricacies of HS codes is crucial for success in the Indian home décor market. Understanding these codes empowers businesses to navigate import and export processes efficiently, ensure accurate tariff calculations, and stay compliant with evolving trade regulations. By embracing a proactive approach to HS code research and utilizing available resources, businesses can optimize their operations and thrive in this dynamic sector.

+Codes-01-1920w.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Home Decor in India: A Comprehensive Guide to Harmonized System (HS) Codes. We hope you find this article informative and beneficial. See you in our next article!