Navigating the World of Home Decor: Understanding Harmonized System (HS) Codes

Related Articles: Navigating the World of Home Decor: Understanding Harmonized System (HS) Codes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Home Decor: Understanding Harmonized System (HS) Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Home Decor: Understanding Harmonized System (HS) Codes

The global trade of home decor items, encompassing everything from furniture and lighting to textiles and decorative accents, is a vast and complex landscape. To effectively manage this trade, a standardized system of classification is essential, ensuring clarity and consistency in the exchange of goods. This system is known as the Harmonized System (HS) code, a globally recognized framework for classifying traded products.

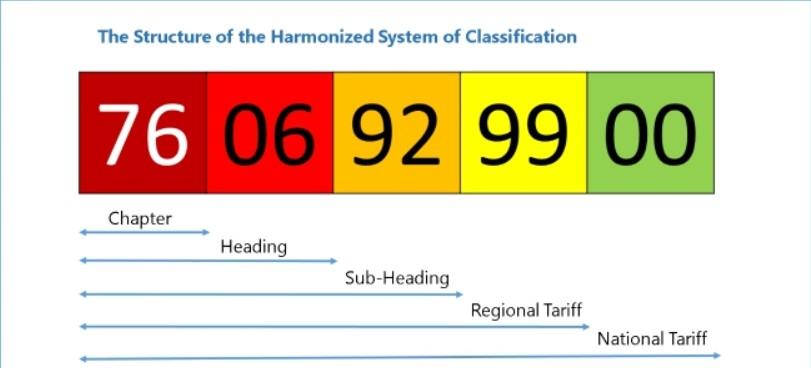

The HS code is a six-digit numerical code assigned to each product based on its material, construction, and intended use. For home decor items, the HS codes fall within a specific range, offering a detailed breakdown of various categories. This comprehensive system provides numerous benefits for both importers and exporters, streamlining trade processes and ensuring accurate documentation.

Decoding the Home Decor HS Code: A Detailed Exploration

The HS code for home decor items is not a single, monolithic code but rather a range of codes encompassing diverse categories. Understanding these codes is crucial for businesses involved in the import and export of home decor products.

Key Categories and Their Corresponding HS Codes:

-

Furniture (HS Codes 9401-9403): This broad category encompasses a wide range of furniture items, including:

- 9401: Furniture of wood: Includes chairs, tables, beds, cabinets, and other wooden furniture.

- 9402: Furniture of metal: Covers metal furniture such as chairs, tables, beds, and office furniture.

- 9403: Furniture of other materials: Includes furniture made from materials like plastic, wicker, and rattan.

-

Lighting Fixtures and Lamps (HS Code 9405): This category includes a variety of lighting fixtures for both indoor and outdoor use, such as:

- 9405.10: Electric lamps and lighting fittings.

- 9405.20: Non-electric lamps and lighting fittings.

- 9405.30: Parts of lamps and lighting fittings.

-

Textiles and Carpets (HS Codes 5701-5705, 5801-5808): This category encompasses various textile products used in home decor, including:

- 5701-5705: Woven fabrics.

- 5801-5808: Knitted or crocheted fabrics.

- 5703: Carpet and other textile floor coverings.

-

Decorative Items (HS Codes 6901-6914, 7001-7021): This category encompasses a wide range of decorative items, including:

- 6901-6914: Ceramics.

- 7001-7021: Glassware.

- 6303: Articles of apparel and clothing accessories.

- 6305: Other made up textile articles.

Understanding the Importance of HS Codes

The HS code system plays a critical role in facilitating international trade by:

- Simplifying Customs Procedures: The standardized classification system allows for efficient customs clearance, reducing delays and ensuring smooth flow of goods.

- Enhancing Trade Statistics: Accurate HS codes provide valuable data for tracking trade flows, analyzing market trends, and informing trade policy decisions.

- Facilitating Trade Negotiations: The HS code serves as a common language for trade negotiations, enabling countries to agree on tariffs and other trade regulations.

- Promoting Transparency and Accountability: The standardized system promotes transparency in trade practices, enhancing accountability and reducing the potential for fraud.

Benefits for Businesses:

- Accurate Product Classification: Correctly identifying the HS code for your product ensures accurate customs declarations and minimizes the risk of delays or penalties.

- Simplified Documentation: The HS code streamlines documentation processes, reducing administrative burdens and saving valuable time.

- Reduced Import Costs: Accurate classification can lead to lower import duties and taxes, ultimately reducing overall costs.

- Improved Market Access: Understanding HS codes provides insights into market regulations and requirements, facilitating access to new markets.

FAQs about Home Decor HS Codes:

1. What is the difference between a tariff code and an HS code?

The HS code is a global classification system for products, while tariff codes are specific to individual countries and determine the applicable import duties. Tariff codes are often based on the HS code, but they may include additional digits for country-specific classifications.

2. How do I find the correct HS code for my home decor product?

There are several resources available to help you determine the correct HS code for your product, including:

- The World Customs Organization (WCO) website: The WCO website provides the official HS code nomenclature, along with explanatory notes.

- National Customs Websites: Most countries have their own customs websites that provide information on HS codes and specific tariff codes.

- Trade Specialists: Consult with trade specialists or customs brokers for assistance in identifying the correct HS code.

3. What happens if I use the wrong HS code?

Using the wrong HS code can lead to delays in customs clearance, penalties, and increased import costs. It is essential to ensure that you have accurately identified the correct HS code for your product.

4. Can the HS code change over time?

The HS code is subject to periodic updates and revisions. It is important to stay informed about any changes to the HS code system to ensure accurate product classification.

Tips for Utilizing Home Decor HS Codes:

- Consult the WCO website and national customs websites for the latest HS code information.

- Seek professional advice from trade specialists or customs brokers to ensure accurate classification.

- Maintain accurate records of all HS codes used for your products.

- Stay informed about any changes or updates to the HS code system.

Conclusion:

The Harmonized System (HS) code is an indispensable tool for businesses involved in the global trade of home decor items. By understanding the various categories and codes within the HS framework, businesses can ensure accurate product classification, streamline customs procedures, and navigate the complex world of international trade with confidence. Proper utilization of HS codes promotes efficiency, transparency, and ultimately, successful global trade in the dynamic and ever-evolving home decor industry.

+Codes-01-1920w.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Home Decor: Understanding Harmonized System (HS) Codes. We appreciate your attention to our article. See you in our next article!