Navigating the World of Home Decor: Understanding HSN Codes and GST Rates

Related Articles: Navigating the World of Home Decor: Understanding HSN Codes and GST Rates

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the World of Home Decor: Understanding HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Home Decor: Understanding HSN Codes and GST Rates

The realm of home decor is vast and diverse, encompassing a wide array of items that enhance the aesthetics and functionality of our living spaces. From furniture and lighting to textiles and decorative accessories, each product falls under a specific classification system, known as the Harmonized System (HS) Nomenclature. This system, used globally, assigns unique six-digit codes, known as HSN codes, to various goods for the purpose of international trade and customs regulation. In India, the Goods and Services Tax (GST) regime further utilizes these codes to determine the applicable tax rate on specific home decor products.

Understanding HSN codes and their corresponding GST rates is crucial for businesses involved in the home decor industry, as well as for consumers seeking to make informed purchasing decisions. This article aims to provide a comprehensive guide to navigating this intricate system, exploring its significance, benefits, and practical applications.

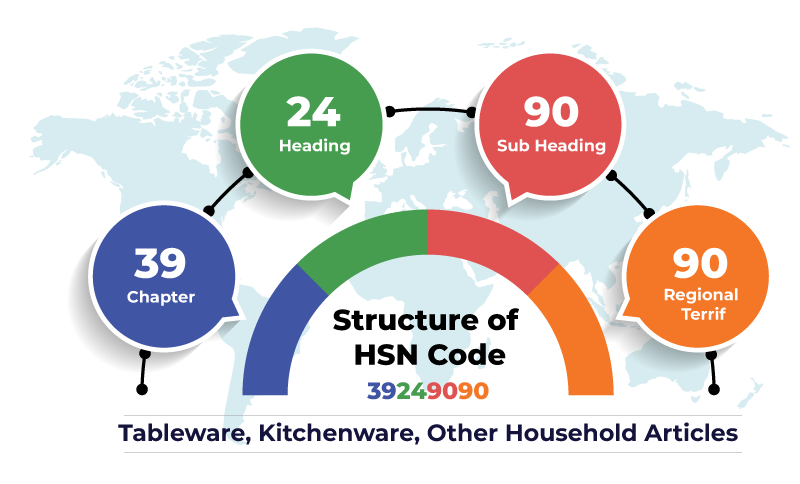

Decoding the HSN Code System:

The HSN code system, a standardized international nomenclature, provides a hierarchical structure for classifying goods based on their characteristics and intended use. Each six-digit code represents a specific product category, allowing for efficient identification and tracking of goods across borders. The first two digits indicate the broader chapter, followed by four more digits that further refine the product category.

Home Decor HSN Codes and GST Rates: A Detailed Breakdown

The GST rates for home decor products are determined based on their HSN codes, which are categorized under various chapters. Here’s a detailed breakdown of some key home decor categories and their corresponding HSN codes and GST rates:

Chapter 63: Articles of Apparel and Clothing Accessories:

- HSN Code 6304: This code encompasses curtains, drapes, and other textile furnishings, often subject to a GST rate of 5%.

- HSN Code 6307: This code includes bed linen, table linen, and other household textiles, typically falling under a GST rate of 5%.

- HSN Code 6309: This code covers carpets and rugs, typically subject to a GST rate of 12%.

Chapter 94: Furniture:

- HSN Code 9401: This code includes furniture for bedrooms, living rooms, and dining rooms, often subject to a GST rate of 12%.

- HSN Code 9403: This code covers mattresses and other bedding accessories, typically subject to a GST rate of 12%.

- HSN Code 9404: This code encompasses furniture for offices, schools, and other institutional settings, typically subject to a GST rate of 12%.

Chapter 95: Toys, Games, and Sports Equipment:

- HSN Code 9503: This code covers decorative ornaments, figurines, and other decorative items, typically subject to a GST rate of 12%.

- HSN Code 9505: This code includes lamps and lighting fixtures, often subject to a GST rate of 12%.

Chapter 96: Miscellaneous Manufactured Articles:

- HSN Code 9618: This code encompasses mirrors, picture frames, and other decorative articles, typically subject to a GST rate of 12%.

- HSN Code 9619: This code covers artificial flowers, plants, and similar decorative items, typically subject to a GST rate of 12%.

Importance and Benefits of Understanding HSN Codes and GST Rates:

- Accurate Pricing and Inventory Management: Businesses can accurately calculate the cost of goods sold and maintain precise inventory records by understanding the applicable GST rates for each product category.

- Compliance with Tax Regulations: Proper classification of goods using HSN codes ensures compliance with GST regulations, minimizing the risk of penalties and audits.

- Informed Purchasing Decisions: Consumers can make informed purchase decisions by understanding the GST implications of different home decor products, comparing prices and making choices that align with their budget.

- Efficient Supply Chain Management: Clear product classification using HSN codes facilitates smooth movement of goods across the supply chain, optimizing logistics and reducing delays.

Frequently Asked Questions (FAQs):

Q1: How can I find the HSN code for a specific home decor product?

A: You can access a comprehensive list of HSN codes and their descriptions on the official website of the Indian government, the GST Council, or through various online resources.

Q2: What happens if I misclassify a product using the wrong HSN code?

A: Misclassification can lead to incorrect GST calculations, potential penalties, and audits. It’s crucial to ensure accurate classification based on the product’s characteristics and intended use.

Q3: Are there any exemptions or concessions for certain home decor products under GST?

A: Some home decor items might be eligible for exemptions or concessions under specific GST rules. Consult the official GST regulations for detailed information.

Q4: How can I stay updated on changes in HSN codes and GST rates?

A: Stay informed by regularly checking the official websites of the GST Council and other relevant government agencies for any updates or modifications to HSN codes and GST rates.

Tips for Effective Utilization of HSN Codes and GST Rates:

- Maintain a comprehensive HSN code database: Create a detailed database of HSN codes for all home decor products you deal with, ensuring accurate classification and tax calculation.

- Seek professional guidance: Consult with tax professionals or accounting experts for assistance in understanding HSN codes and GST implications, particularly for complex product categories.

- Stay informed about GST updates: Regularly monitor official sources for any changes in GST rates or HSN code classifications, ensuring compliance with the latest regulations.

- Utilize online resources: Leverage online tools and databases that provide comprehensive information on HSN codes and GST rates, facilitating efficient product classification.

Conclusion:

Understanding HSN codes and their corresponding GST rates is essential for businesses and consumers operating within the home decor industry. By effectively utilizing this system, businesses can ensure accurate pricing, inventory management, and compliance with tax regulations. Consumers, in turn, can make informed purchasing decisions, comparing prices and selecting products that align with their budget. As the home decor landscape continues to evolve, staying informed about HSN codes and GST updates remains crucial for navigating this dynamic market successfully.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Home Decor: Understanding HSN Codes and GST Rates. We thank you for taking the time to read this article. See you in our next article!