Navigating the World of Home Decor with HSN Codes and GST

Related Articles: Navigating the World of Home Decor with HSN Codes and GST

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the World of Home Decor with HSN Codes and GST. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Home Decor with HSN Codes and GST

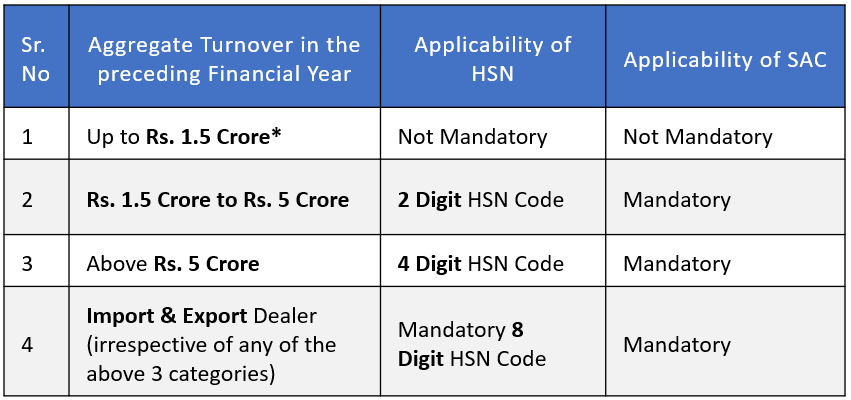

The realm of home décor encompasses a vast array of products, each with its unique characteristics and specific tax implications. To ensure clarity and streamline transactions, the Harmonized System Nomenclature (HSN) code system has been established, providing a standardized classification framework for goods traded internationally. In India, the Goods and Services Tax (GST) regime further refines this system, assigning specific GST rates to different HSN codes, impacting pricing and tax liabilities. Understanding the interplay of HSN codes and GST within the home décor industry is crucial for businesses and consumers alike.

Decoding the HSN Code System

The HSN code system, developed by the World Customs Organization (WCO), employs a six-digit numerical code to categorize goods based on their material, manufacturing process, and intended use. These codes are hierarchical, with broader categories at the top and increasingly specific classifications as the code progresses. For instance, the HSN code for "furniture" is 9401, while "beds" fall under 9401.10, further differentiating into "metal beds" (9401.10.00) and "wooden beds" (9401.10.10).

GST and its Impact on Home Decor

In India, the GST regime, implemented in 2017, replaced a complex web of indirect taxes with a unified system. The GST Council, comprising representatives from the central and state governments, sets the GST rates applicable to various goods and services. These rates are categorized into four slabs: 5%, 12%, 18%, and 28%, with certain items exempt from GST.

Home Decor HSN Codes and their Corresponding GST Rates

The GST rates applicable to home decor products are determined by their HSN code classification. Here’s a breakdown of common home décor categories and their corresponding GST rates:

| **Category | HSN Code | GST Rate** |

|---|---|---|

| Furniture | 9401, 9403 | 12% |

| Lighting Fixtures | 9405 | 12% |

| Decorative Items | 3926, 6810, 7013, 9404 | 12% |

| Curtains and Draperies | 6307 | 5% |

| Rugs and Carpets | 5701, 5702 | 12% |

| Wallpapers | 4814 | 18% |

| Kitchenware | 7323, 8516 | 12% |

| Bathroom Fixtures | 6910, 8419 | 12% |

| Home Appliances | 8509, 8516 | 18% |

Navigating the GST Landscape: A Practical Guide

Understanding the interplay of HSN codes and GST rates is crucial for businesses operating in the home décor industry. Here’s a practical guide to navigate this landscape:

1. Accurate Classification:

- Consult the HSN Code Manual: The official HSN code manual published by the Directorate General of Commercial Intelligence and Statistics (DGCI&S) provides a comprehensive list of HSN codes and their corresponding descriptions.

- Seek Expert Guidance: If unsure about the correct HSN code for a particular product, consult with a tax consultant or chartered accountant.

2. Compliance with GST Regulations:

- Registration: Businesses dealing with home décor products must register with the GST authorities and obtain a GST Identification Number (GSTIN).

- Filing Returns: Regularly file GST returns, including details of sales, purchases, and tax liability, as per the prescribed timelines.

- Issuing Invoices: Ensure all invoices issued to customers include the correct HSN code, GST rate, and GSTIN.

3. Understanding the Impact on Pricing:

- Input Tax Credit (ITC): Businesses can claim input tax credit on purchases of goods and services used in their business operations, including home décor products. This reduces their overall tax liability.

- Output Tax Liability: Businesses must charge GST on their sales of home décor products, which is calculated based on the applicable GST rate and the value of goods sold.

- Pricing Strategy: Businesses need to factor in GST rates when setting prices for their products to ensure profitability and remain competitive in the market.

4. Consumer Awareness:

- GST Invoice: Consumers should request and retain a GST invoice for all home décor purchases, as this serves as proof of purchase and helps in claiming any applicable input tax credit.

- Price Transparency: Consumers should be aware of the GST component included in the price of home décor products, ensuring they understand the true cost.

FAQs on Home Decor HSN Codes and GST

Q1: What is the difference between HSN codes and GST rates?

A: HSN codes are a standardized classification system for goods, while GST rates are the tax percentages applied to these goods based on their classification.

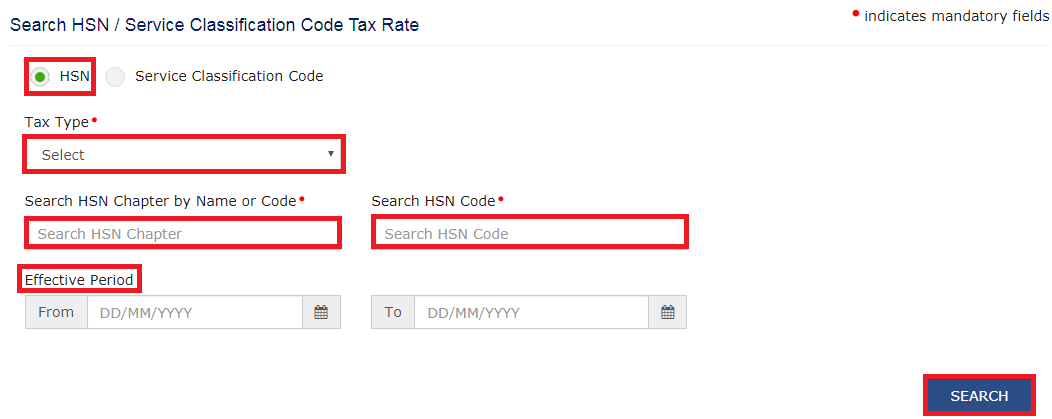

Q2: How do I find the correct HSN code for a home décor product?

A: Consult the HSN code manual published by DGCI&S or seek expert guidance from a tax consultant.

Q3: Are all home décor products subject to GST?

A: Most home décor products are subject to GST, but certain items may be exempt. Refer to the GST Council’s notifications for specific exemptions.

Q4: Can I claim input tax credit on home décor purchases?

A: Businesses registered under GST can claim input tax credit on purchases of home décor products used in their business operations.

Q5: How does GST impact the price of home décor products?

A: GST is typically included in the final price of home décor products, leading to a slight increase in cost compared to pre-GST times. However, the input tax credit mechanism can offset this increase for businesses.

Tips for Businesses in the Home Decor Industry

1. Stay Updated: Regularly monitor changes in GST rates and HSN code classifications announced by the GST Council.

2. Maintain Proper Records: Keep accurate records of all purchases, sales, and GST payments for audit purposes.

3. Utilize Technology: Employ accounting software or online platforms to streamline GST compliance processes and manage tax records effectively.

4. Consult Experts: Seek advice from tax consultants or chartered accountants to ensure compliance with GST regulations and optimize tax benefits.

5. Educate Customers: Inform customers about the GST component in product pricing and the benefits of retaining GST invoices.

Conclusion

The HSN code system and GST regime have brought about significant changes in the home décor industry, requiring businesses and consumers to adapt to a new tax landscape. By understanding the HSN codes associated with different home décor products and the corresponding GST rates, businesses can ensure compliance with tax regulations, optimize pricing strategies, and maximize profitability. Consumers, in turn, can make informed purchasing decisions and understand the true cost of home décor products. This knowledge empowers both businesses and consumers to navigate the world of home décor with greater clarity and confidence.

![What is an HSN Code? HSN Codes Explained - TFG Guide [Updated 2024]](https://tradefinanceglobal.com/wp-content/uploads/2018/07/HSN-Codes-Naming-System.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Home Decor with HSN Codes and GST. We hope you find this article informative and beneficial. See you in our next article!